A Rewarding Way to Earn Cash

05/01/2018

Opening a Rewards Checking account with Valley FCU is pretty rewarding. See what we did there? When you become a member at Valley FCU, you become an owner. Our profits are returned to members through higher rates on deposits and lower rates on loans. That lets us provide you with a rewarding experience that you’re going to enjoy. Check out what we have in store for you.

Earning cash rewards with your checking account may sound like a dream, but at Valley it’s what you’ll find. As part of your ownership, Valley returns dividends on checking and savings accounts. Currently, with our Rewards Checking account you earn up to 2.50% APY* on balances up to $10,000 when qualifications are met. When you open a Rewards Checking account with Valley you’ll also open a Rewards Savings account. You’ll earn a 0.75% APY** on balances up to $20,000 and a 0.25% APY** on balances over $20,000 when the qualifications are met.

High dividend rates aren’t the only reason that Valley’s Rewards Checking account is a great deal though. You’ll also enjoy a low minimum opening deposit of $50, free online banking with bill pay, no monthly service fee and a free debit card. Plus, you’ll receive access to 30,000 nationwide CO-OP ATMs and refunds on ATM fees up to $20 per month. That means you’ll have access to your money when and where you need and you won’t have to worry about those pesky ATM fees anymore.

Earning your cash rewards is really simple. During each Monthly Qualification Cycle, you’ll need to have the following transactions and activities:

- At least 15 debit card purchases post and settle.

- At least 1 automatic payment (ACH) or direct deposit post and settle.

- Be enrolled in and agree to receive eStatements.

- Be enrolled in and log into online banking.

That’s all there is to it! Don’t worry if you don’t meet the qualifications each month though. There is no penalty to worry about and you’ll still have a checking account that earns our base rate of dividends. Once you meet the qualifications again, you’ll be back to receiving great dividends and ATM fee refunds nationwide.

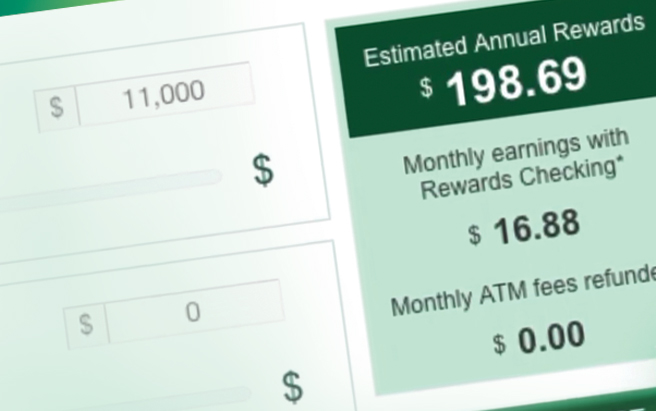

Now, if you’re wondering how much you’ll earn each month, we have you covered. Just visit our Rewards Checking calculator and answer three questions to find out your estimated annual rewards, monthly earnings, and monthly ATM fee refunds!

To start earning your rewards, you can open an account online or stop into one of our branches. We’ll be happy to help you open an account today. Cash rewards at Valley FCU, that’s the right move!

*APY=Annual Percentage Yield. APYs accurate as of 4/1/2018. Rates may change after account is opened. $50 minimum to open Rewards Checking and $1 to open Rewards Savings. $25 savings required for membership. If qualifications are met each monthly qualification cycle: (1)ATM fees incurred using Rewards Checking check card during qualification cycle will be reimbursed up to $20 and credited to account on the first day of the next monthly statement cycle; (2)balances up to $10,000 receive APY of 2.50%; and (3)balances over $10,000 earn 0.05% dividend rate on the portion of the balance over $10,000, resulting in 2.50% - 0.05% APY depending on the balance. If qualifications are not met on Rewards Checking all balances earn 0.05% APY. Qualifying transactions must post to and clear Rewards Checking account during monthly qualification cycle. Transactions may take one or more banking days from the date transaction was made to post to and clear account. Transfers between accounts do not count as qualifying transactions. "Monthly Qualification Cycle" means one calendar month. The advertised Rewards Checking APY is based on compounding dividends. Dividends earned in Rewards Checking is automatically transferred to Rewards Savings each statement cycle and does not compound. Actual dividend amount paid may be less than advertised Rewards Checking APY. The Rewards Savings APYs may be less than Rewards Checking APYs. Fees may reduce earnings.

**APY=Annual Percentage Yield. APYs accurate as of 4/1/2018. Rates may change after account is opened. Monthly direct deposit required to have these accounts. $50 minimum to open Rewards Checking and $1 to open Rewards Savings. $25 savings required for membership. For Rewards Checking, if qualifications are met each monthly qualification cycle ATM fees using Rewards Checking check card incurred during qualification cycle will be reimbursed up to $20 and credited to account on the first day of the next monthly statement cycle. Qualifying transactions must post to and clear Rewards Checking account during monthly qualification cycle. Transactions may take one or more banking days from the date transaction was made to post to and clear account. Transfers between accounts do not count as qualifying transactions. "Monthly Qualification Cycle" means one calendar month. Dividends earned in Rewards Checking is automatically transferred to Rewards Savings each statement cycle and does not compound. Actual dividend amount paid may be less than advertised Rewards Checking APY. The Rewards Savings APYs may be less than Rewards Checking APYs. If qualifications in Rewards Checking account are met each monthly qualification cycle: (1)balances up to $20,000 in Rewards Savings account receive an APY of 0.75%; and (2)balances over $20,000 in Rewards Savings account earn 0.25% dividend rate on portion of balance over $20,000, resulting in 0.75% - 0.25% APY depending on the balance. If qualifications are not met on Rewards Checking, all balances in Rewards Savings account earn 0.05% APY. Fees may reduce earnings.